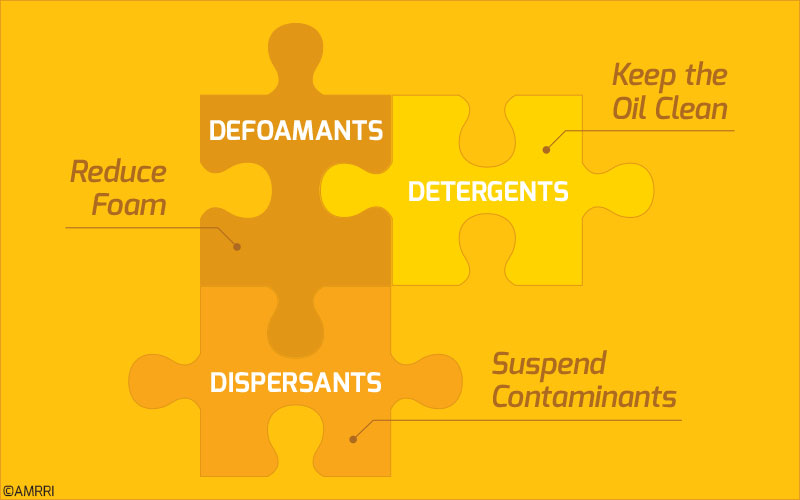

For the three additives we spoke about earlier, each of them is sacrificial in one way or another.

Defoamants get used up when they are called upon to reduce the foam in the oil. On the other hand, detergents and dispersants use their characteristics to suspend contaminants in the oil.

In all of these scenarios, each of these additives can be considered to become depleted over time. While performing their functions, they will undergo reactions that reduce their capability to perform them more than once.

Hence, it can be concluded that these additives become depleted over time even though they may not have physically left the oil but now exist in a different form.

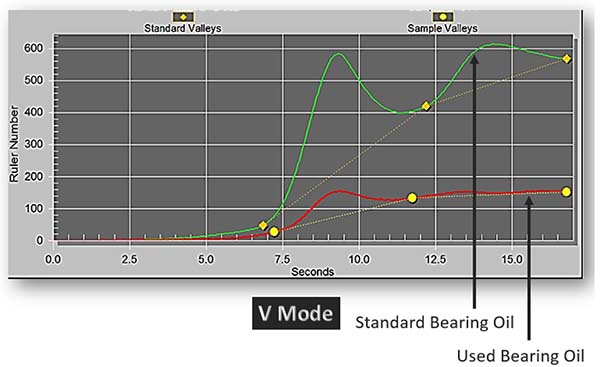

The air release property of the oil is affected by the loss of defoamants. This value will see a significant rise, indicating that it takes longer for air to be released from the oil. As such, air remains in the oil in either a free, dissolved, entrained, or foam state.

Consequently, this impacts the ability of the oil to lubricate the components properly and can even result in microdieseling and increased oil temperatures in the sump.

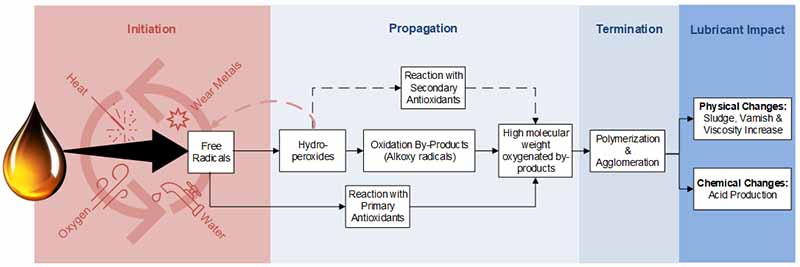

On the other hand, as the detergents and dispersants are reduced, the capacity of the oil to hold contaminants also decreases.

Therefore, one will begin noticing that deposits may start forming on the equipment’s insides, leading to valves sticking (especially in hydraulic systems) or a general increase in the system’s temperature as these deposits can trap heat.

With the introduction of an increased temperature, the oil can begin oxidizing, leading to more deposits being formed and possibly even varnish.

Essentially, these additives are essential to the health of the oil in your system. The detergents and dispersants can help to keep your system clean (free from contaminants such as soot).

The defoamants can even reduce the risk of wear, increased temperatures to the lube system, the potential to form varnish, or the possibility of succumbing to microdieseling.

References

1 Bruce, R. W. (2012). Handbook of Lubrication and Tribology – Volume II Theory and Design – Second Edition. Boca Raton: CRC Press, Taylor & Francis.

2 Mang, P., & Dresel, D. (2007). Lubricants and Lubrication – Second Edition. Weinheim: WILEY-VCH Verlag GmbH & Co KGaA.

4 Mang, P.-I., Bobzin, P.-I., & Bartels, D.-I. (2011). Industrial Tribology Tribosystems, Friction, Wear and Surface Engineering, Lubrication. Weinheim: WILEY-VCH Verlag & Co KGaA.

3 Mortier, D. M., Fox, P. F., & Orszulik, D. T. (2010). Chemistry and Technology of Lubricants – Third Edition. Dordrecht Heidelberg: Springer.